Competitiveness and Comparative Advantage of Rice Production Systems: The Policy Analysis Matrix Approach

Policy Research Brief 102December 2019

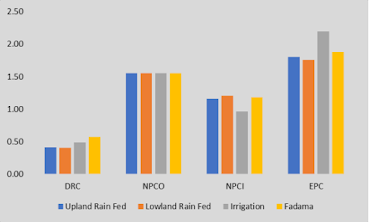

Diagram 1: PAM indicators for Rice Production Systems

Sule, B. A., Crawford, E. and Coker, A. A. A.

Introduction

The Federal Government of Nigeria, through the Agriculture Promotion Policy (APP) (2016-2020) and Economic Recovery and Growth Plan (ERGP) (2017- 2020), proposed to increase domestic rice production and improve its competitiveness with imports by employing a combination of trade policies (import tariffs and bans), input policy, institutional reforms, and direct investments along the rice value chain, among other strategies. Kebbi State is one of the major producers of rice in Nigeria with a fair representation of the various rice production ecologies in the country. Under the APP, the state government has instituted key interventions to increase agricultural productivity. The focus has been on the rehabilitation of existing irrigation systems, construction of new dams and irrigation schemes, and use of improved technologies (Kebbi State Government, 2017, Central Bank of Nigeria, 2016). This is necessary sequel to the federal government’s 2016 re-introduction of the ban on rice importation through Nigeria’s land borders. By implementing these policies, it is expected that the gap between rice supply and demand will finally be bridged (Federal Ministry of Agriculture and Rural Development, 2016). There have been speculations as to whether achieving selfsufficiency in rice production, as planned by the Nigerian Government, would benefit the producers and the economy. Consequently, the focal point of this study is to determine the competitiveness and comparative advantage of rice production systems in Kebbi State, Northwest Nigeria, using the Policy Analysis Matrix (PAM). Price policies employed by governments change the value of output or the costs of inputs thereby affecting the private profitability of the farming system. It is therefore necessary to find out whether farmers earn profits facing actual market prices. While private profitability indicates the competitiveness of the agricultural systems (given current technologies, output values, input costs, and policy transfers), social profits indicate whether a country uses scarce resources efficiently and has a static comparative advantage in the production of that commodity at the margin (Monke and Pearson, 1989; Pearson et al., 2003)

Key Findings

1) Production systems are competitive given current market prices and policy transfers.

2) Government policy incentives for small-scale rice farmers lead to inefficient use of scarce resources

3) Trade policies increase the price of rice to consumers as well as producers

4) Rice production in the study area is currently economically profitable without government incentives

5) Competitiveness is driven by productivity hence policies that encourage adoption of improved technology would help sustain the competitiveness of rice production.

Methodology

The PAM is a computational framework developed by Monke and Pearson (1989) for measuring input use efficiency in production, private profitability (competitiveness), economic profitability (comparative advantage), and the degree of government intervention (Nelson and Panggabean, 1991). The PAM is a product of two accounting identities: the profitability identity, which defines profitability as the difference between revenues and costs, and the divergences identity, which measures the effects of divergences (distorting policies and market failures). This is the difference between observed parameters and parameters that would exist if the divergences were removed. Through the PAM, it becomes possible to measure both the extent of divergences stemming from the set of policies acting on the system and the inherent economic efficiency of the system. Using survey data collected in the 2017/2018 farming seasons, average data points were used in estimating the variables for the PAM analysis. Financial profitability of the production systems to the producers, economic benefit to the country, and the effect of policy interventions by the government were considered. For the financial analysis, actual market prices faced by farmers were used in assessing the competitiveness of the production systems while for the economic analysis, input and output market prices were converted into social values to reflect the economic cost to society. For the purpose of this analysis, the type of rice produced was assumed to be the same and was valued at the same price for all systems An estimated 12% overvaluation of the naira was used for the analysis (International Monetary Fund (IMF), 2017).

Table 1: Policy Analysis Matrix for Rice Production Systems Note:

System | Values | Revenue | Tradable costs | Domestic factor costs | Profit |

| Financial | A | B | C | D |

| Economic | E | F | G | H |

| Divergence | I | J | K | L |

Upland Rain Fed |

Financial |

585,109

|

173,271

|

98,426

|

313,413

|

|

Economic |

377,677

|

149,406

|

93,417

|

134,855

|

|

Divergence |

207,432

|

-23,865

|

-5,009

|

178,558

|

Lowland Rain Fed

|

Financial |

527,558

|

152,356

|

91,033

|

284,168

|

|

Economic |

340,529

|

126,516

|

86,517

|

127,495

|

|

Divergence |

187,029

|

-25,840

|

-4,516

|

156,673 |

Irrigation |

Financial |

642,661

|

210,381

|

102,202

|

330,078

|

|

Economic |

414,826

|

217,908

|

96,701

|

100,217

|

|

Divergence |

227,835

|

7,527

|

-5,501

|

229,861

|

Fadama |

Financial |

470,006

|

168,523

|

95,997

|

205,486

|

|

Economic |

303,380

|

142,718

|

91,974

|

68,688

|

|

Divergence |

166,626

|

-25,805

|

-4,023

|

136,798

|

Private profits D = A - B – C Social profits: H = E - F – G

Output divergences I = A – E Input divergences J = F – B

Factor divergences K = G – C Net divergences L = I+J+K

The analysis in Table 1 indicates positive values for both financial and economic profitability for all the production systems in the study area. This is true despite the fact that policy divergences for tradable inputs and domestic factors are negative (financial costs exceed social costs), which is an indication of negative policy incentives for use of tradable inputs and domestic factors in rice production, except for irrigation systems where divergences for tradable input costs were positive. The net policy incentive effects (divergences on revenue plus divergences on inputs and factors) are also positive for all rice production systems.

Competitiveness of Rice Production Systems

The private profitability values for all production systems as shown above (Table 1) were found to be positive. This is an indication that all systems were competitive given current market prices and policy transfers. The irrigation system was the most competitive system, with the highest profit of about ₦330,078 followed by the upland rain-fed system. The least competitive was the fadama system.

Comparative Advantage of Rice Production Systems

The value of social profit gives a measure of economic efficiency since outputs and inputs are valued in prices that reflect their economic costs to the society. The outcome of the economic analysis in Table 1 showed that social profits for all production systems were positive; this indicates that all systems are economically efficient. The least efficient was the fadama system with an economic profit of about ₦68,688. The Domestic Resource Cost ratio (DRC) is a measure of the economic efficiency (comparative advantage) of a production system. The values of the DRC (as indicated in Diagram 1) are less than 1 for all systems. This implies that it costs less than one unit of domestic resources to generate an additional unit of foreign exchange from rice cultivation. Thus, it is cheaper for the country to produce rice locally than to import.

Effect of Policies on Rice Production Systems

The third row of the PAM (Table 1) measures the divergences between the financial and social values, and hence the magnitude of incentives for local rice production. The Nominal Protection Coefficient for Output (NPCO = A/E) measures the effects of policy intervention on output prices. The value of 1.50 (seen in Diagram 1) indicates that agricultural policies are increasing the market price of rice to a level 50 percent higher than the world price. The Nominal Protection Coefficient for Input (NPCI = B/F) is also above one for all the production systems except irrigation. This shows that financial prices of inputs are also higher than the economic or world prices, which is a disincentive to farmers. The exception is the irrigation system, which uses a different mix of tradable inputs. The Effective Protection Coefficient (EPC = A-B/E-F) indicates the combined effect of policies in the tradable commodities markets. This is a useful measure because input and output policies (such as commodity price supports and fertilizer subsidies) are often part of the policy package, and one may be offsetting the other. The EPCs for all systems were also greater than one (negative divergence in inputs offset by positive divergence in outputs). This indicates that government policies provide net positive incentives to rice producers in the study area (subsidy).

Policy Relevance

The results of the study indicate that all production systems are effectively subsidized by government policies, which allows them to obtain higher financial profits than economic profits. Even though the introduction of price and trade policies increases rice farmers’ incomes on balance, three important tradeoffs resulting from the implementation of these policies should be considered. One is that such strategies increase the price of rice within Nigeria (as evidenced by the financial price being higher than the economic price). This is a disadvantage to the Nigerian populace, the majority of whom are low income earners. This may have negative consequences on the nutrition status of Nigerians by pushing more families beneath the poverty line. The second is that rice import tariffs do not improve economic efficiency because they lead to inefficient use of scarce resources in the economy. The third is that the Government is incurring a budgetary cost for subsidizing fertilizer, yet our results showed that rice production in Kebbi State is financially profitable even when valuing fertilizer at the unsubsidized market price. Lastly, considering that the competitiveness of the systems is driven by productivity, the study results suggest that the Government should invest more in development and promotion of improved rice production technology as this would increase farmer’s productivity and, in the long run, translate into higher revenues and profits. This will further reduce the need for distorting policies and keep the price of rice more affordable for consumers.

References

1. Central Bank of Nigeria (CBN) (2016). Financial Inclusion Newsletter. Volume 1, Issue 2.

2. Federal Ministry of Agriculture and Rural Development (FMARD) (2016). Promotion Policy 2016- 2020: Building on the Successes of the ATA, Closing Key Gaps. Policy and Strategy Document.

3. Kebbi State Government (2017). Governor Bagudu Year One: Snippets from The Agricultural Sector. Retrieved from http://kebbistate.ng

4. Monke, E. A. and Pearson, S. R. (1989). The Policy Analysis Matrix for Agricultural Development. Ithaca: Cornell University Press, Chapter 13, pp. 261-265.

5. Nelson, G.C. & Panggabean, M. (1991). The Cost of Indonesian Sugar Policy: A Policy Analysis Matrix Approach. American Journal of Agricultural Economics 73: 703-712.

6. Pearson, S., Gotsch, C., & Bahri, S. (2003). Applications of the Policy Analysis Matrix in Indonesian Agriculture. Available Online: http://www.stanford.edu/group/FRI/Indonesian/newregional/newbook.pdf.4

This Policy Research Brief was prepared for USAID/Nigeria by Michigan State University (MSU), Federal Ministry of Agriculture and Rural Development (Nigeria), and the International Food Policy Research Institute (IFPRI) under the USAID/Nigeria funded Food Security Policy Innovation Lab Associate Award, contract number AID1-620-LA-15- 00001.

This research is made possible by the generous support of the American people through the United States Agency for International Development (USAID) under the Feed the Future initiative. The contents are the responsibility of study authors and do not necessarily reflect the views of USAID or the United States Government.

Copyright © 2019, Michigan State University. All rights reserved. This material may be reproduced for personal and not-for-profit use without permission from but with acknowledgement to MSU and IFPRI. Published by the Department of Agricultural, Food, and Resource Economics, Michigan State University, Justin S. Morrill Hall of Agriculture, 446 West Circle Dr., Room 202, East Lansing, Michigan 48824

About the Author

Sule, B. A. is PhD candidate, Federal University of Technology Minna, Nigeria

Crawford, E. is Professor, Development Economics. Michigan State University,

Coker, A. A. A. is Senior Lecturer, Federal

Comments

Post a Comment